November 2023: Pistons and Turboprops Stable As Jet Prices Decline

As we approach the end of the year, the aircraft marketplace is showing the first signs of at least plateauing, driven largely by a continued shallow increase in some pistons and most turboprops, but a notable drop in light, mid and heavy jet values.

Piston-Engine Aircraft and Turboprops:

A Stable Market

In the realm of piston-engine aircraft and turboprops, the market is showing stability after a period of relative meteoric rise that began in the summer of 2020 has slowed. The growth in this sector has been flat, with no significant rise or decline. This stagnation suggests a balanced demand and supply, possibly indicating a mature market where new innovations or shifts in buyer preferences are minimal. A key upward pressure that is often overlooked (even in a down market) is that the cost of newly manufactured aircraft vs. comparable models that are 50+ years old. (Consider Cessna 206s and 182s which both average around $200K used vs. $650K new)

For investors and operators in this segment, this stability can be a sign of predictability, allowing for more accurate forecasting and planning. If you are thinking of selling during this period, we have a Pro Seller Program designed to optimize your sale with real-time market data—just like this report. At any rate, onto the jets.

The Depreciating Aircraft Market:

Jets Leading the Decline

A pivotal trend in the current aircraft marketplace is the overall depreciation in prices, with jets at the forefront of this downward trajectory. The market has seen an average depreciation of 5.4%, a considerable rate that signals a shift given the history of the last three years. This decline in jet prices is likely a function of corporate profits and high net worth individuals reaching a point where new entrants have been adequately satisfied leaving less pressure on a market that normally saw depreciation as a constant.

Jet Market Analysis Part 1:

Legacy Models with Long Production Runs

To understand this depreciation category more concretely, examining jet models that have been in the marketplace for multiple decades sheds light on the pricing pressure of new airframe and powerplant technology (higher capital carrying costs with lower direct operating costs) versus good value in legacy jet aircraft (lower capital carrying costs with higher direct operation costs.)

Hawker 900: This model, representing older midsize jets, has seen a depreciation of 4.9% in the last 30 days. The Hawker model was in continuous production since 1962 through 2012. While the original HS-125 changed significantly over the years, this model is worth tracking due to the standard it set in the business aviation community for 50 plus years.

Learjet 31A: Experiencing a sharper depreciation of 7.9%, the Learjet 31A's decline is significant. This model's larger depreciation rate is a function of a reduction in demand and also a range of modern light jet options with fundamentally better operating costs such as the Citation CJ series and Phenom 300. While all are considered light jets, the CJ4 and Phenom offer improved cabins and full authority digital engine control (FADEC), simply items that older light jets can’t compete with. (With the exception of the Beech 400 Nextant upgrade.)

Lear 60: Similarly, the Lear 60 has seen a depreciation of 8.1%, aligning with the trend observed in other older jet models. The Lear 60, while extremely fast and a mid-size cabin, is outclassed cabin and technology wise by newer offerings.

Jet Market Analysis Part 2:

Popular Current Production Jets

A good contrast to Part 1 above is looking at a similar category of aircraft of long production runs and popularity, but with the caveat that they are still in production, and most likely boast upgraded default avionics and powerplants.

Challenger 300 / 350: Experiencing about ½ the depreciation pressure of its older competitors of 2.9% the Challenger will likely hold strong due to its charter popularity and performance. It also found a sweet spot to replace its older cousin the 600 Series Challengers, yet doing it in the Super-mid category.

Citation CJ Series: The CJ series has been around since the 1990s, however, it has been heavily modified and improved from the original CitationJet through the CJ4+. At a 3.2% over the last 30 days, this aircraft is seeing downward pressure, but in contrast to the Lear 31A above, it is seeing about ½ the pressure mostly likely due to an updated airframe and avionics suite relative to comparative older light jets.

Falcon 900 Series: The depreciation of 3.5% for the last 30 days in this large cabin jet also trends about ½ of the depreciation in the group above.

Gulfstream VI Series: With a depreciation of 4.2%, the 650ER is being hit pretty hard aligns closer to the market average, indicating its stability compared to other models.

Global Express Series: With market demand strong for the ultra long haul heavy jet category, the Globals as a group saw 1.6% depreciation in the last 30 days. While significant, this model performed the best of the group sampled for looking at a 30 day look back.

From Piston Land:

The Venerable Cessna 182 Skylane

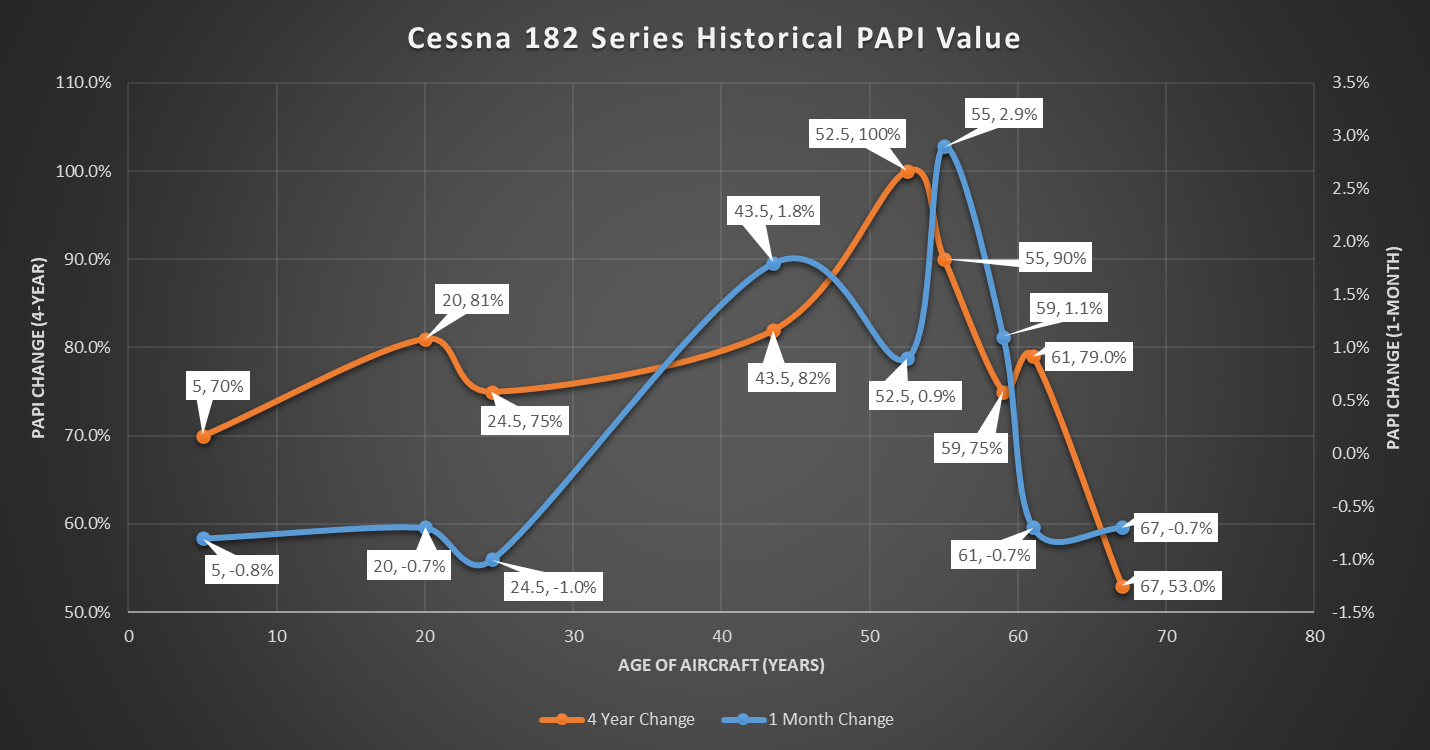

For the bulk of Planephd’s users, however, of much more interest is the hangar staple - the Cessna 182 Skylane. The graph below shows the last 30 day depreciation against the last 4 years and 20 years. The insights to be gained here are mainly how steep the climb was since the end of 2019 and how they are stabilizing now across many different vintages of Cessna 182.

Market Implications

The depreciation in jet prices, especially in older models, has several implications:

Buyer's Market: The current trend shows a gradual return to a favorable environment for buyers, offering more competitive prices and a wider selection of aircraft. If you are thinking of acquiring during this time of year, our Pro Buyers Program can answer any questions along the way.

Investment Caution: For investors, this depreciation signals the need for caution, especially in the midsize and older jet segments.

Upgrade Opportunities: Operators of older jets might find this an opportune time to consider upgrading to newer models, taking advantage of the lower prices in the depreciating market with the caveat that models see a true increase in value with the upgrades.

Market Correction: The decline in prices is largely a normal market correction, adjusting for previous overvaluations due to strong post COVID interest in business aviation that has been largely unprecedented in business and private aviation. (Much like we saw with some single engine pistons such as the Cessna 182).

The beginning of a flattening or slight decrease the Cessna 182 realm in the more recent model years is also telling. Previously we could have expected a risen trend across the board. Now that the market is cooling, however, the higher valued CE-182s are facing the correction first. The key question for the marketplace and owners is whether the older Skylanes will continue their long slow appreciation, or be brought back down to reality as the demand for Cessna 182 is satisfied by inventory.

A key question (and driver) that remains is what is the pressure applied from new entrants into private aviation via first private pilots and ones that are instrument rated. The Cessna 182, historically, has presented the natural post training “first airplane” for many new pilots looking to have a cross country machine that gets the job done.

Stay tuned for next month's update as we see how the general aviation market moves into the new year.