How PAPI Guides Pro Buyers

Challenge: Volume and Frequency

One of the challenges when we first started collecting aircraft transaction data (back in the 2014) was that traditional valuation methods have two critical flaws:

- small data sample sizes

- published data that lags real time market conditions

Simply put: Not enough data and not updated fast enough. Aircraft valuations are a moving target, especially during a global pandemic when everyone suddenly wants their own private point to point transportation.

PAPI's Evolution: A Skywagon Story

In the case of the photo above, we could look at the CE 180 / 185 market. Even before COVID this market was showing appreciation that outpaced other single engine pistons - but by how much? On a macro level three factors were at play:

- demand - an increasing amount of buyers (retiring boomers, looking for fun)

- supply - a dwindling supply of Cessna 185 Skywagons (working Alaska CE 185s are not often for sale)

- popularity - a growing interest in back country flying (fueled even more so by the pandemic)

But there is a more quantitative way to see these bullet points.

The raw number of Cessna 185 transactions tracked by Planephd informed our Precision Aircraft Pricing Index (PAPI) not only reflected the Cessna 185 specifically, but high performance taildraggers in general. In the last ten years, the amount of transactions was not only increasing, but the price per aircraft was also increasing, despite an aging fleet, with high airframe times. The value of data at scale, specifically by looking at this make and model as an example, allows savvy buyers to make the right offer.

PAPI and the Pro Buyer Program: A Piper Malibu Study

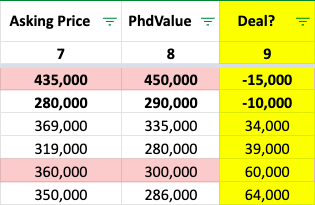

In the table below, we can see a typical aircraft "deal finder" chart that is part of the Pro Buyer Program. The Piper Malibu faced a purchasing frenzy during COVID and continues to do so. It is the entry level aircraft if you want to get above the weather and need to do long distance flying.

Can't afford a jet or a turboprop? No problem, the Malibu or the Cessna P210 has you covered.

The key edge a PAPI analysis offers a Pro Buyer Program client is a simple relative assessment:

Where is the ask relative to what it will likely sell for?

If you look under the column "Deal?" you'll notice the difference between how under or over the Seller's asking price is relative to what our data compilation will show that it will sell for. The top two aircraft that are bolded (-$15K and -$10K respecitively) are priced below what they would normally transact for.

But, how is this possible? Seller's using legacy metrics for evaluating what is the right price to sell their aircraft for aren't getting the benefit of what the marketplace is actually reflecting:

An increase in aggregate asking prices and related shorter times on market. Those two factors alone, provide a trend indicator for each make and model analyzed.